What Is Loan - Meaning, Benefits and Importance

Ever thought about taking a loan but didn't act on it because you weren't aware of its basics? You're not alone.

In India, only 27% of people understand how loans and finances actually work. This is one of the reasons why borrowing money from lenders is still the last resort for many.

But guess what? The concept of loans isn't as complex as it sounds. Read this blog as we break down the loan meaning, key components, benefits, and more.

What is a Loan?

A loan is an amount you borrow from a lender, usually a bank or an NBFC, with an obligation to pay it back with interest. It is used to fund education, pay bills, buy a house, or meet other financial needs.

Also Read: what is nbfc

Types of Loans in India

There are various types of loans one can borrow from a bank or NBFC in India, such as -

1. Based on the Security Provided

- Secured Loan - Loans provided against collateral (like property or assets) are called secured loans. Since they are safer for the lender, they carry lower interest rates. Examples: home loan, car loan, etc.

- Unsecured Loan - Loans that are provided without collateral are called unsecured loans. They are high-risk credits and carry high interest rates. Examples: personal loan, credit card loan, etc.

2. Based on the Purpose

- Personal Loan - A loan used to meet personal financial needs, like paying bills or consolidating debt, is called a personal loan. It's unsecured and paid back within 12 to 36 months.

Need a personal loan immediately? Check out our Instant Personal Loan App now!

- Home Loan - As the name suggests, a loan that is taken to buy, build, or renovate property is called a home loan. It is provided against the property itself.

- Education Loan - A loan used for funding education - whether graduate, post-graduate, master's, or diploma - is called an education loan. It's provided for both domestic and international studies.

- Two-Wheeler Loan - This is a loan taken to buy a two-wheeler (bike or scooter). The vehicle itself acts as collateral.

- Car Loan - A car loan is the same as a two-wheeler loan, except that it's taken to buy a car.

- Business Loan - A business loan is borrowed to start, run, or expand a business. You can also use it to buy equipment, manage cash flow, or hire staff.

3. Based on the Pledged Assets

- Gold Loan - A gold loan is a loan that is sanctioned against gold as collateral.

- Loan Against Assets - When you pledge assets, like land or property, to get a loan, it's called a loan against assets.

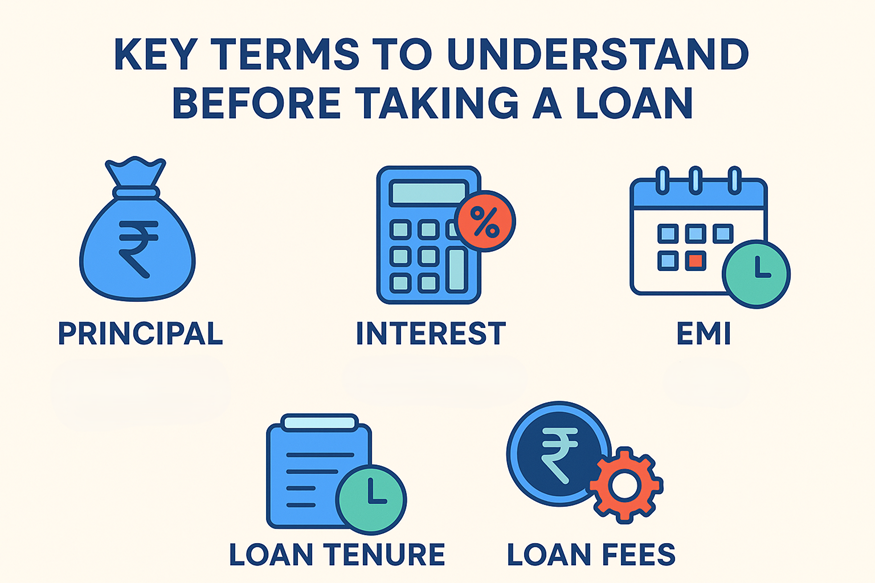

Key Terms to Understand Before Taking a Loan

The most difficult aspect in navigating the world of loans is understanding their various terminologies. So, here are a few key loan terms simplified for you -

- Principal: The principal is the loan amount you get.

- Interest: The amount you repay over and above your loan principal is called interest. It is charged on the principal amount as a percentage called the interest rate, which is either fixed or floating.

- EMI: The small monthly instalments in which you repay the loan are called EMIs (Equated Monthly Instalments). They include both principal and interest.

- Loan Tenure: The period within which you need to repay the loan is called the loan tenure.

- Loan Fees: Any charges you pay over and above your loan EMIs are called loan fees. They typically include processing fees, prepayment penalties, etc.

Benefits of Taking a Loan in India

Getting a loan for the first time can feel intimidating, especially if you don't know about its pros. So, here are a few advantages of a loan -

- Offers Financial Flexibility: Loans are versatile and offer unmatched financial flexibility. You can use them to finance anything - from home appliances to a home.

- Builds Credit History: When you take a loan and repay it without defaults, it builds your credit history. This makes it easier for you to get funds in the future.

- Helps Avoid Asset Liquidation: Whether you take a secured loan or an unsecured loan, you don't have to sell any assets to get the money. You can keep your valuables intact while covering expenses.

- Tax Benefits: One of the best benefits of a loan is the tax advantages that it entails. Home loans and education loans qualify for deductions under the Income Tax Act of India, reducing your total tax burden.

Factors Affecting Your Loan Eligibility in India

Wondering how to get a loan in India? Well, here are the eligibility criteria to get you started -

- Age & Citizenship: To qualify for a loan in India, you should be a 21- to 58-year-old Indian citizen.

- Credit Score: A credit score rates your creditworthiness and is particularly important to get a personal loan. The ideal credit score for Indian lenders is often between 650-750 or above.

- Employment: Lenders also evaluate your source of income. They check if you're salaried or self-employed.

- Income: Your monthly revenue, whether through a job or a business, is another important factor. To avail a personal loan, it should be a minimum of ₹15,000/month.

- Existing Debt: Your debt-to-income ratio should be between 20%-40%. This indicates your existing debt burden is manageable.

See how much personal loan you're eligible for—try our Personal Loan Eligibility Calculator!

Common Mistakes to Avoid When Taking a Loan

If you're a first-time borrower, take note of the following loan mistakes. They can reduce your credit score, get you rejected, and even hurt your prospects of getting a loan -

- Borrowing Extra - If you apply for a loan amount more than what you can comfortably repay, lenders will reject your application. So, always assess your financial needs before applying.

- Late EMI Repayments - If you don't pay your EMIs on time, it will hurt your credit score. Remember, lenders don't provide loans to applicants with poor credit scores (less than 650).

- Ignoring Loan Terms and Conditions - Every lender has their own loan terms and conditions, interest rates, etc. So, always read the fine print to avoid any future disputes.

Kick Out Doubts - Get Your First Loan With Hero FinCorp

Want to take a loan for the first time? It's normal to have questions, but getting one doesn't have to be difficult. Once you know the eligibility criteria, interest rates, and repayment options, you can borrow confidently and without stress.

Why wait? Streamline your finances today and apply for your personal loan with Hero FinCorp!

FAQs

1. What documents do I need for a loan application?

To apply for a loan, you'll need proof of ID, address, and income. However, every lender has different requirements.

2. What is the difference between a two-wheeler loan and an instant personal loan?

A two-wheeler is a secured loan in which your vehicle is the collateral. Contrastingly, an instant personal loan is an unsecured loan with no collateral.

3. Can I get a loan with a low credit score?

Yes, you can get a loan with a low credit score. However, it can negatively impact your interest rate and loan terms.