Credit Utilisation Ratio: Meaning, Calculation & How To Improve

India’s credit hunger might have hit its peak.

It’s no random speculation; according to a recent study, Indians collectively spent ₹21.16 lakh crore in FY25 through credit cards, marking a record high surge of 15%!

On an individual level, it means we’re all swiping way more than before. This means a higher credit utilisation ratio and lower loan approval chances.

Wondering how both are connected? Read this blog as we discuss the credit utilisation ratio, its meaning, calculation method, impact on your future loans, and improvement tips.

What is the Credit Utilisation Ratio?

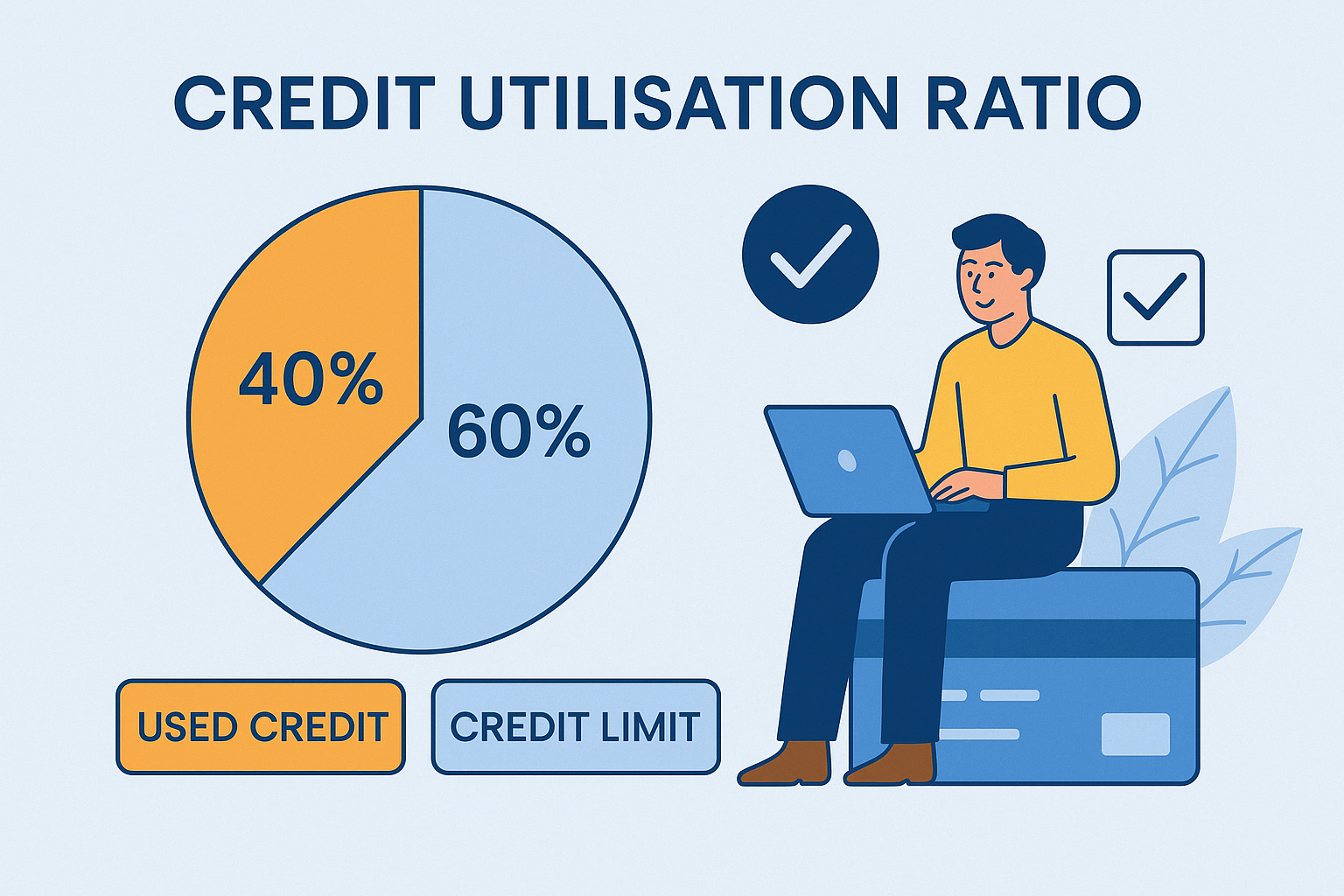

A Credit Utilisation Ratio (CUR) shows the amount of credit you’ve used against the total available limit. It is expressed as a percentage and accounts only for revolving credit, such as credit cards or personal lines of credit.

This metric is useful for both lenders and borrowers. Banks and NBFCs check an applicant’s CUR to gauge their credit dependence. A high percentage signals risk, which can affect loan approval, interest rates, and overall creditworthiness.

On the other hand, borrowers track their CUR to manage their credit reliance and appear eligible for new loans. Keeping it low shows responsible usage and helps them maintain a strong CIBIL score.

Know your CIBIL score for free—calculate it here!

How Does Credit Utilisation Work?

Figuring out how credit utilisation works might seem tricky. But it’s actually pretty simple.

With revolving credit, you’re given a limit, and you can borrow, repay, and borrow again. CUR measures how much of that limit you’re currently using. So, if your credit limit is ₹100,000 and your outstanding balance is ₹40,000, your CUR is 40%.

Lenders and credit bureaus (CIBIL, Experian India, etc.) watch this number closely. A low CUR tells them you use credit responsibly. A high CUR signals you might be relying too heavily on borrowed money. That directly affects your credit score and drops your chances of getting a new loan or better terms.

But that’s not all—there’s also a psychological and financial angle. A high CUR often means you’re constantly pushing your limits, which can lead to debt stress, minimum-due traps, and impulse borrowing.

Need funds for an emergency? Try our Instant Loan App to avail personal loans of up to ₹5 lakhs now!

How to Calculate Credit Utilisation Ratio?

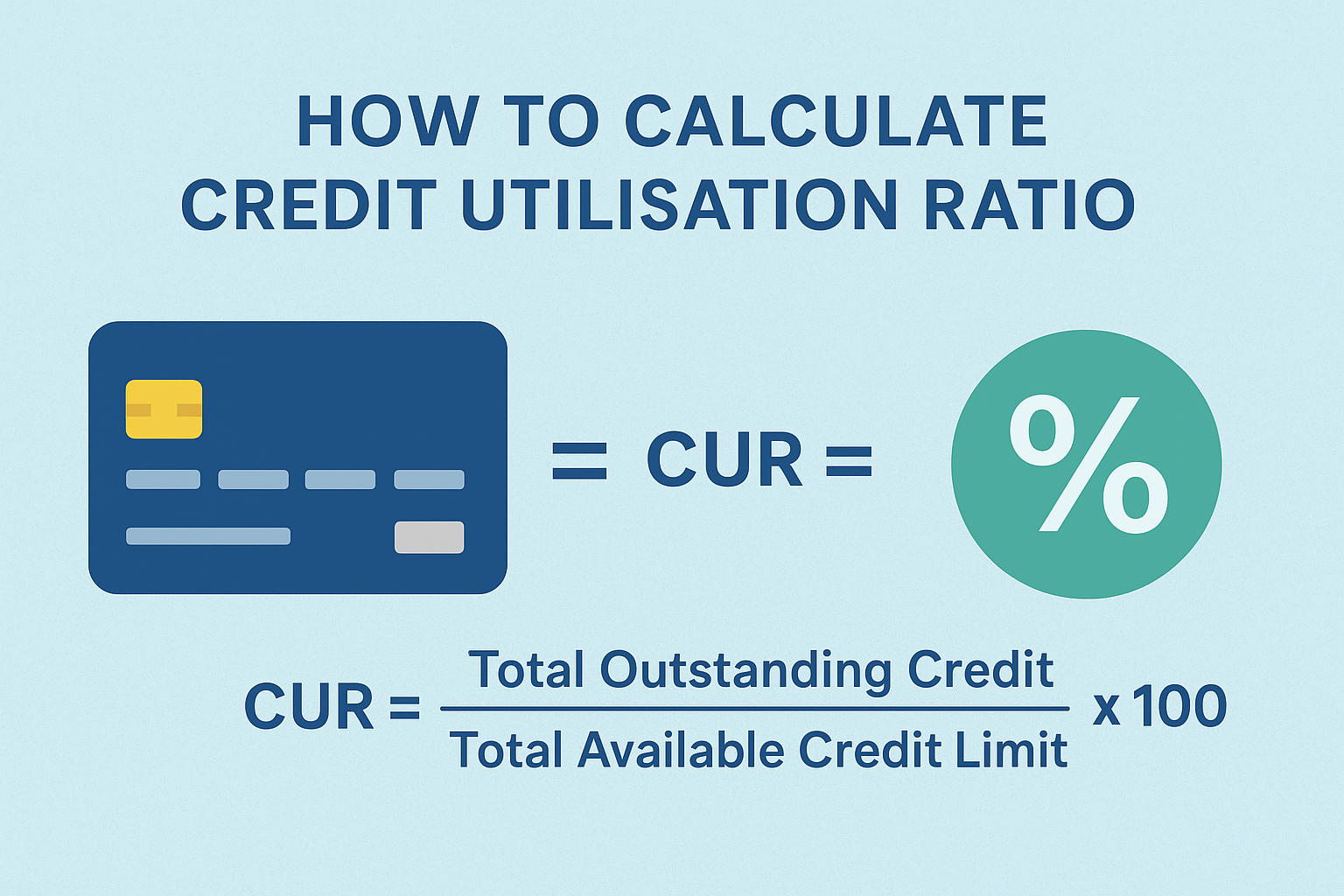

Here’s the formula for credit card utilisation ratio calculation:

| CUR = (Total Outstanding Credit / Total Available Credit Limit) x 100 |

Now, let’s put this into perspective.

Suppose you own three credit cards. The total available credit limits on those cards are ₹15,000, ₹20,000, and ₹25,000, respectively, whereas their outstanding balances are ₹5,000, ₹9,000, and ₹10,000, respectively.

Therefore, your CUR will be;

Therefore, your CUR will be;

CUR = (Total Outstanding Credit / Total Available Credit Limit) x 100

CUR = (5000 + 9000 + 10000 / 15000 + 20000 + 25000) x 100

CUR = (24000 / 60000) x 100

CUR = 0.4 x 100

CUR = 40%

Check your personal loan eligibility in minutes. Try our Personal Loan Eligibility Calculator now—it’s free!

Example of Credit Utilisation Ratio

Now, let’s put this into perspective.

Suppose you own three credit cards. The total available credit limits on those cards are ₹15,000, ₹20,000, and ₹25,000, respectively, whereas their outstanding balances are ₹5,000, ₹9,000, and ₹10,000, respectively.

Therefore, your CUR will be;

Therefore, your CUR will be;

CUR = (Total Outstanding Credit / Total Available Credit Limit) x 100

CUR = (5000 + 9000 + 10000 / 15000 + 20000 + 25000) x 100

CUR = (24000 / 60000) x 100

CUR = 0.4 x 100

CUR = 40%

Check your personal loan eligibility in minutes. Try our Personal Loan Eligibility Calculator now—it’s free!

What is a Good Credit Utilisation Rate?

Different credit bureaus have unique cut-offs to determine an ideal credit utilisation ratio. However, a credit utilisation below 30% is an ideal figure. For instance, if your credit limit is Rs 1 Lakh, your utilisation should not exceed Rs 30,000 at any time.

How to Reduce Your Credit Utilisation Ratio?

Now that you know how is credit utilisation calculated and what the ideal CUR is, here are a few tips to reduce your credit utilisation and improve your loan eligibility:

- Keep Your Expenses Under Control: Even if you have a high credit limit, avoid using it to the fullest. Try to keep your expenses under control while remembering the 30-70 rule. When you utilise 30% of the credit limit on one card, try balancing it with other cards. Avoid using that card until you pay its bill or at least the minimum amount to keep your CUR below 30%. Follow this calculation each month on all cards to reduce your credit utilisation ratio.

- Repay the Credit Card Bills in Full: No matter how much credit limit you consume, ensure you pay the entire balance each month. Remember, clearing your credit card dues each month affects your credit utilisation ratio. Repaying the bill in full or making substantial payments each month will help keep your CUR within limits. Even if you cannot make the full payment, keep your outstanding balance low to achieve a low CUR.

- Avoid Using All Credit Cards: Keeping zero balance on some credit cards is another simple way to reduce your credit utilisation rate. When trying to reduce your CUR, avoid using a couple of cards for a few months. It is a simple trick to increase your available credit limit, eventually cutting down your CUR. However, you cannot achieve the goal if you continue overspending on other cards. Therefore, check your total credit limit and plan your expenditure within its 30%.

- Increase Your Credit Limit: If you maintain a good standing on a credit card account for over a few months, you can request an increase in your credit limit with the card issuer. An increased credit limit will help you reduce your CUR, provided you do not increase your expenditure as well.

- Apply for a New Credit Card: Obtaining a new credit card will automatically increase your total credit limit, eventually reducing your credit utilisation with the same expenditure.

Conclusion

Knowing how to calculate credit utilisation helps manage your credit health. Reducing your CUR can boost your credit score and improve your chances of getting new loans from Hero FinCorp with favourable terms and conditions.

A Personal Loan Calculator, a free-to-use tool on the Hero FinCorp website, can help you plan repayment with budget-friendly EMIs and boost your credit score. Remember, a healthy CUR demonstrates responsible credit behaviour and paves the way to a brighter financial future.

Frequently Asked Questions

1. Is a 30% credit utilisation ratio better than a 50% ratio?

The lower your credit utilisation ratio, the better. Therefore, a 30% CUR is better than a 50% CUR.

2. What is the best credit card utilisation ratio?

Ideally, a credit utilisation ratio of up to 30% is the best CUR.

3. Is 50% credit card utilisation good?

A 50% credit card utilisation is good, but 30% is the ideal figure that most credit rating agencies expect.

4. What is the 30-rule rule for credit cards?

When you get a credit card, remember its limit and avoid using more than 30% of it. This is the 30% rule for credit cards.

5. Is it okay to use 40% of credit cards?

Occasionally, using 40% of a credit card limit is fine. However, 30% is the ideal number you should maintain on average.

Disclaimer- The material and information contained on this website is for information purposes only. You should not rely upon material or information on the website as a basis for making business/legal decisions.