How Loan EMIs Are Calculated: A Simple Guide to Manage Your Finances

Many of us grow up listening to this old Indian saying: “Stretch your legs only as far as your blanket allows.” The idea is simple: you must live within your means.

While this wisdom applies to various facets of life, it’s particularly instrumental in personal finance management. More so, when it comes to debt and liabilities. After all, you should only borrow what you can repay.

This is why you should know your EMI beforehand, whether you’re planning a ₹3 lakh personal loan or a ₹5 lakh loan. Let’s explore how to calculate EMI for personal loans and why it matters for your financial well-being.

How to Calculate EMI for Personal Loan: Step-by-Step Guide

Calculating your EMI gives a snapshot of your monthly outflow. Knowing how much you’ll pay every month helps plan your budget better.

Here's the formula for EMI calculation -

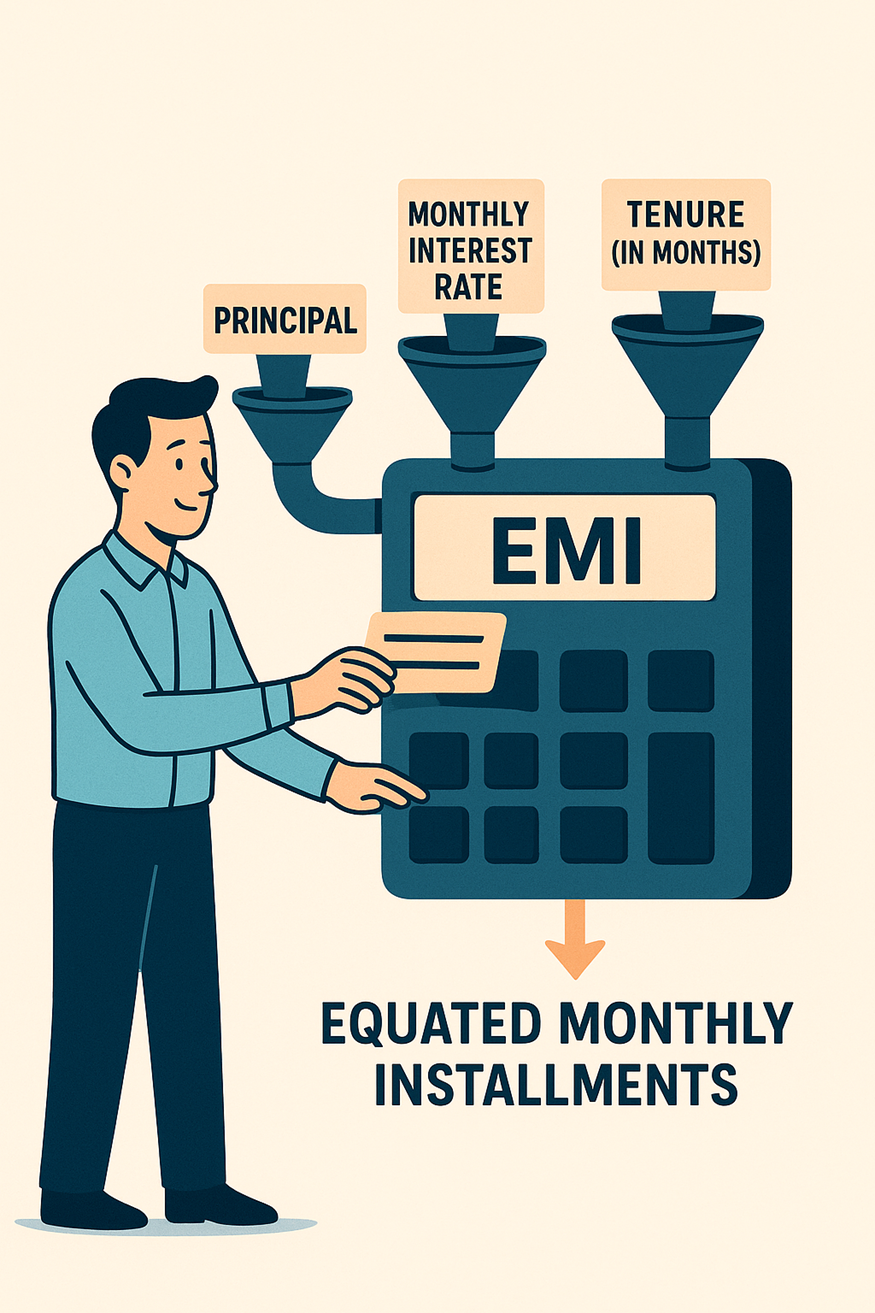

EMI = [P * R * (1 + R)^{N}] / [(1 + R)^{N} - 1]

Where -

- P = Principal loan amount

- R = Monthly interest rate (annual interest divided by 12 × 100)

- N = Loan tenure in months

Let’s understand this better with an example. Suppose you’ve taken a personal loan of ₹4 lakh at an annual interest of 12% for 3 years. Here,

P = 4,00,000

R = 12 / (12 × 100) = 1% or 0.01

N = 12 * 3 = 36

Enter these values into the formula -

EMI = [P * R * (1 + R)^{N}] / [(1 + R)^{N}1]

EMI = [4,00,000 * 0.01 * (1.01)^{36}] / [(1.01)^{36} - 1]

EMI = ₹13,300 (approximately)

So, your monthly EMI will be around ₹13,300. But calculating your EMIs manually leaves room for errors. That's why reputed NBFCs like Hero FinCorp offer an online EMI Calculator to get an exact figure instantly.

Also Read: what is personal loan pre payment

Different Methods for EMI Calculation

There are two major methods for computing EMIs in India. Understanding both helps you make an informed borrowing decision.

| Method | Flat-Rate Method | Reducing-Balance Method |

|---|---|---|

| How It Works | Interest is calculated on the entire loan amount for the full tenure, regardless of how much principal you’ve already paid. | Interest is charged only on the remaining principal balance. As you repay, both interest and EMI components adjust. |

| Interest Behaviour | Fixed. Interest remains constant throughout the loan term. | Declines over time as the principal reduces. |

| Ease of Calculation | Simple to compute. Common in short-term loans. | Slightly complex, but far more accurate. |

| Total Interest Paid | Higher overall cost, as interest doesn’t reduce with repayments. | Lower overall cost since interest falls each month. |

Most lenders, including Hero FinCorp, use the reducing-balance method. It’s fairer and more cost-effective for borrowers.

Factors Affecting Your Personal Loan EMI

Several factors determine your EMI amount. Understanding these helps you plan smarter, whether for a ₹3 lakh personal loan or a ₹5 lakh personal loan. These include -

- Principal Amount - A higher loan amount would attract a higher EMI.

- Interest Rate - Even a small change in rate can significantly impact your monthly payment.

- Loan Tenure - Longer tenures will make EMIs smaller, but they’ll also increase interest.

- Prepayment - Partial prepayments reduce your liability and shave off some sum from your EMIs.

Benefits of Calculating EMI Before Applying for a Personal Loan

Knowing your EMI in advance is a smart move. Here’s why -

- You’ll borrow only what you can comfortably repay.

- Staying on top of your liabilities helps you plan your monthly expenses smartly.

- Knowing your EMI amount earlier eliminates repayment stress and prevents defaults. This, paired with timely payments, improves your credit health.

- Calculating EMIs helps compare lenders and choose the most affordable option.

In short, the benefits of EMI calculation in advance promote long-term financial stability and help you manage your finances stress-free.

Why Choose Hero FinCorp Calculator for Your Personal Loan EMI Calculations?

The Hero FinCorp EMI Calculator simplifies your loan planning journey. You get instant, accurate, and transparent results to make informed borrowing decisions.

With competitive interest rates, digital loan processing, quick approvals, and flexible repayment options, Hero FinCorp makes personal finance effortless. Apply for a personal loan today to get funds instantly. But before that, try our EMI calculator and take the first step towards smarter loan management.

Frequently Asked Questions

1. What is the standard EMI tenure for personal loans?

Personal loan tenure typically ranges from 12 to 36 months.

2. What will be the EMI for a personal loan with different tenures?

Shorter tenures have higher EMIs but lower total interest. On the other hand, longer tenures bring down EMIs but increase interest costs.

3. Does an interest rate change affect EMI on personal loans?

Yes. Any increase or decrease in the interest rate directly impacts your EMI amount.

4. Can I reduce the EMI for my personal loan through prepayment?

Yes. Making prepayments reduces your outstanding balance. This reduces your EMIs and tenure.