Types of Loans: 8 Different Types You Should Know

Asha wants a house, and Vikram wants a vehicle. Both need loans, but learn the hard way that one loan will not cover every need. Asha needs a long-term loan secured by property, while Vikram needs a loan collateralised by a vehicle.

That simple difference changes eligibility, interest and paperwork. Knowing the types of loans helps you pick the one that fits your situation and budget, rather than guessing and paying more later.

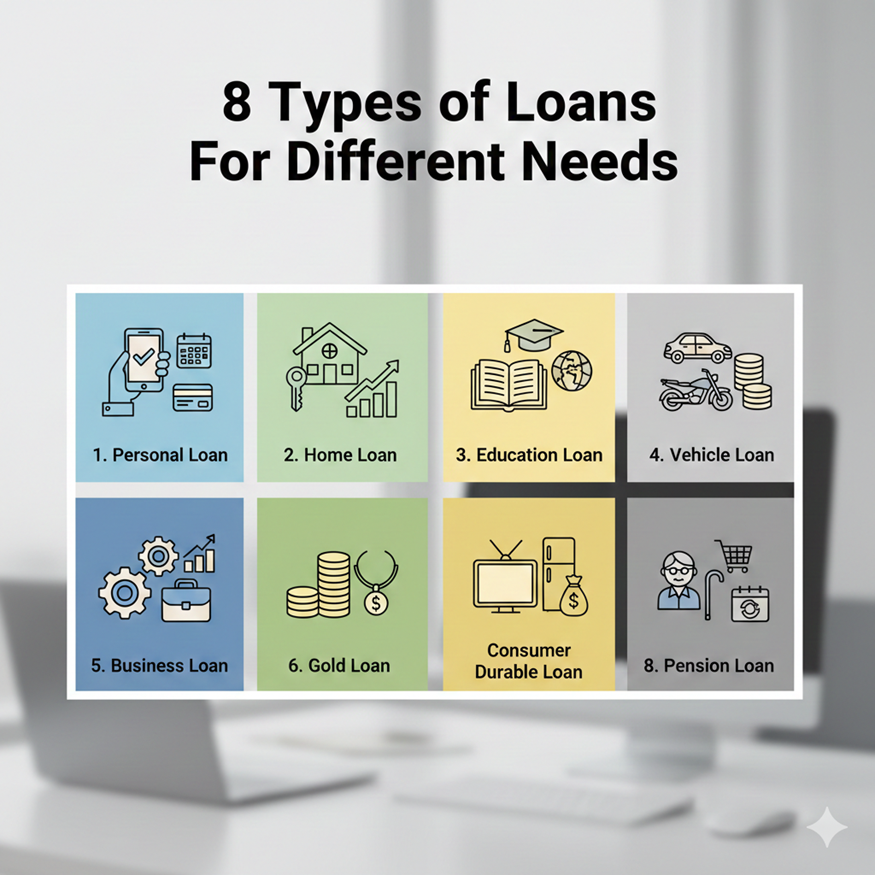

8 Types of Loans to Explore in India

Here are the major loan categories you’ll come across in India and beyond. Explore them with your financial goals in mind:

Also Read - What is Loan?

1. Personal Loan

A personal loan is usually an unsecured loan, meaning no collateral is required. In this type of loan, lenders approve your loan application after verifying your income and credit history. People use personal loans for emergencies, weddings, travel, medical bills or debt consolidation.

Common uses and features:

● Covers urgent or planned expenses

● Quick application with minimal documentation

● Instant disbursal for eligible applicants

● No collateral needed

If you’re looking for instant funds, download our instant loan app and enjoy quick approvals!

2. Home Loan

A home loan is a secured loan in which the property serves as collateral. This is the most popular type of loan in India, as it offers longer tenure and generally lower interest rates than unsecured options. Home loans often come with tax benefits under applicable laws.

Common variants:

• Purchase a loan for buying a ready property

• Construction loan for building on land you own

• Top-up loan for additional funds on an existing home loan

• Balance transfer to move your loan to a lower-rate lender

3. Education Loan

Education loans fund higher education in India or abroad and are the best type of loan for students. Eligibility usually depends on admission proof and the co-applicant's income. Most lenders offer a moratorium period that starts after the course ends. Typical features include deferred repayment and variable tenures tied to the course length.

4. Vehicle Loan

Vehicle loans finance new or used cars and two-wheelers. The vehicle itself serves as collateral in a two-wheeler loan while you repay over an agreed tenure. Lenders set interest rates based on your credit profile and the vehicle's age. These car loans are practical for predictable purchase plans and often offer monthly EMI options.

Also Read: Your Guide to Using a Personal Loan for Used Car Financing

5. Business Loan

Business loans support working capital, inventory purchase or expansion for small and medium enterprises. Lenders assess business financials, turnover and cash flow when deciding eligibility. Options exist as secured loans backed by assets and unsecured loans based on business performance. Repayment terms and documentation vary by lender and product.

6. Gold Loan

Gold loans are secured loans, which means you give gold jewellery or coins to get quick cash in case of emergencies. They are popular because you get faster approvals with less documentation. Tenures are usually short, and interest rates can be competitive compared with those for unsecured emergency borrowing. This is a practical option when you need immediate liquidity.

7. Consumer Durable Loan

A consumer durable loan covers appliances and electronics at the point of sale. Retail finance often lets you use these types of loans in India, where you buy now and pay over a short tenure with EMIs.

Lenders sometimes offer zero-down-payment or no-cost EMI deals, subject to terms. These loans are tailored for planned purchases and come with straightforward documentation.

8. Pension Loan

Pension loans are designed for senior citizens and pensioners who need extra cash. Lenders consider pension proof and repayment capacity rather than regular salary slips. Repayment terms are structured to suit fixed pension inflows. This type of loan for senior citizens helps cover unexpected medical or household expenses.

Now, let's revisit Asha and Vikram. Asha, with the help of these loan types, can easily make the choice of a home loan that will be in line with her long-term plan, while Vikram can pick a vehicle loan that is specifically designed for his next purchase. Understanding the distinctions between the two loans allows them not only to borrow but also to do so wisely, saving on costs they would otherwise incur.

Also Read: What Is a Term Loan – Types, Example & Steps to Apply Online

How to Select the Most Suitable Loan for Your Situation?

Before you apply for credit, it is necessary to understand and choose loans that are in accordance with your financial goals and repayment capacity. Once you have a good grasp of the different choices available, the next step is to link the loan to your reasons, money, and time.

Confirm eligibility, compute EMIs, and check interest rates of different banks as part of the things you need to do. In addition to the loan amount, consider the loan duration, fees, and paperwork required before applying.

Remember the following tips:

● Assess the purpose and choose secured or unsecured accordingly

● Run EMI estimates and ensure monthly payments fit your budget

● Check the impact on your credit score and avoid multiple simultaneous applications

● Read prepayment and foreclosure terms to avoid hidden costs

At Hero FinCorp, we make the loan application process easy with quick approvals and minimal documentation. So why wait? Install our personal loan app now and get instant access to funds whenever you need them.

Frequently Asked Questions

What are the main types of loans available in India?

Personal loans, home loans, education loans, etc., are the major types of credit available in India.

How do secured and unsecured loans differ?

Secured loans require collateral, like a house or car, whereas unsecured loans do not. Also, secured loans have lower rates, while unsecured loans’ rates depend on the borrower's credit score.

Which kind of loan is the most appropriate for emergencies?

You can take a personal loan or a gold loan in case of an emergency. Gold loans can be quicker when you have jewellery to pledge.

How many types of personal loans exist?

Personal loans differ by lender and purpose. You can find EMI-based personal loans, top-up loans, and loans for specific needs like debt consolidation.

Is it possible to get a loan without any collateral?

It is possible. In fact, certain loans, such as personal loans or some business loans, are unsecured. Your approval is based on your income and credit history.

What factors affect loan approval and interest rates?

These are the factors that influence loan approval and interest rates: credit score, income, job security, current debts, and the ratio of loan amount to property value if the loan is secured.