Instant Loan Amount

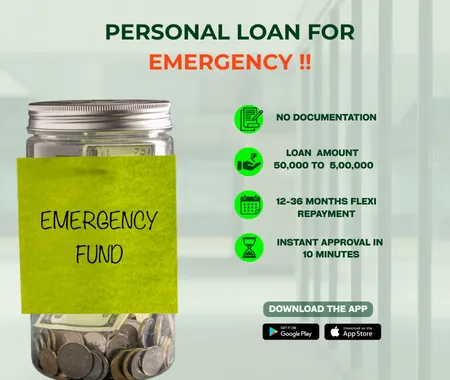

You can get loans ranging from Rs 50,000 to 5 Lakh at competitive interest rates.

Need money urgently? Get quick help with an Urgent Personal Loan online. Apply online with transparent terms and get quick decision-making on your application.

Life can be unpredictable, and emergencies often require quick action. If you are in urgent need of money, having instant access to funds can make all the difference. We offer emergency Personal Loans of up to Rs 5 Lakh to help you manage those urgent financial needs. You can apply online and get a quick eligibility check and approval in less than 10 minutes. With interest rates starting at 19% p.a.(as of 2023), minimal documentation, flexible repayment options, and no collateral requirement, Hero FinCorp, an RBI-licensed NBFC, makes borrowing simple, secure, and transparent for a stress-free experience.

Worried about the EMI amount when applying online? We offer competitive interest rates to make repayment easier. Your EMIs are determined by your eligibility and repayment capacity, based on the loan amount, interest rate, and tenure. The table below provides an illustrative example of potential EMIs, and is not a final offer.

| Loan Amount | Tenure (in Months) | Interest Rate (per annum) | Monthly EMI | Total Interest | Total Amount Payable |

|---|---|---|---|---|---|

| Rs 5,00,000 | 12 | 19% | Rs 46,078 | Rs 52,936 | Rs 5,52,936 |

| Rs 5,00,000 | 18 | 19% | Rs 32,142 | Rs 78,556 | Rs 5,78,556 |

| Rs 5,00,000 | 24 | 19% | Rs 25,204 | Rs 1,04,896 | Rs 6,04,896 |

| Rs 5,00,000 | 30 | 19% | Rs 21,066 | Rs 1,31,980 | Rs 6,31,980 |

| Rs 5,00,000 | 36 | 19% | Rs 18,328 | Rs 1,59,808 | Rs 6,59,808 |

Here are the key features and benefits to know before applying for a Personal Loan for Emergency.

| Criteria | Requirement |

|---|---|

| Age | You should be between 21 and 58 years at the time of applying. |

| Citizenship | You should be a citizen of India. |

| Work Experience | 1. Salaried Employee: You should have at least 1 year of experience with at least 6 months in the current company. 2. Self-employed: You should have a business vintage of at least 2 years. |

| Monthly Income | You should have a minimum net monthly income of Rs 15,000. |

| Credit Score | A healthy CIBIL Score, typically 750 or above, is preferred for faster processing. |

The following documents are required for both salaried and self-employed applicants to complete their loan application instantly.

When taking an urgent loan online, it’s important to know about additional charges. Getting instant funds shouldn’t cost more. Our loans come with transparent fees with no hidden costs.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting from 19% p.a. |

| Loan Processing Charges | Minimum 2.5% + GST (As per RBI guidelines, this is capped at a reasonable amount.) |

| Prepayment Charges | 0% for loans fully serviced for over 12 months (as per 2025 NBFC norms). |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs. 350/- (Subject to change) |

| Interest on Overdue EMIs | 1–2% of the loan/EMI overdue amount per month (Applicable on the overdue amount only) |

| Cheque Bounce | Fixed nominal penalty (Check loan agreement) |

| Loan Cancellation | 1. Cancellation Fee is Zero if cancelled within the stipulated cooling-off period and before disbursement. 2. The interest amount paid is non-refundable. 3. Processing charges are also non-refundable & non-adjustable. |

Planning to take a loan for an emergency online? Here is a step-by-step process to apply easily and quickly:

Visit our website.

Click on the Instant Personal Loan tab and select "apply now".

Enter your mobile number. You will receive an OTP to register yourself.

Select the loan amount you want.

Complete KYC verification and check eligibility.

Click submit and complete your online loan application.

An emergency Personal Loan provides quick funds when urgent money is required. Whether it's for medical expenses, an unexpected repair, or other emergency expenses, We can help you to get quick access to funds within a matter of minutes.

Common reasons to take out a loan for emergency needs include:

Downloading the urgent loan app is quick, secure, and user-friendly. If you have an urgent loan required, you can set up and access quick funds any day at any time using a mobile device. Here is how to do that:

Go to Google Play Store (for Android), or Apple App Store (for iOS) on your device.

Search for “Hero FinCorp” using the search bar.

Find the official loan app in the app store when you search.

Click "Install" and download.

Click on the app icon and give the necessary permissions.

Sign up and log in.

Set up your profile to explore instant loan options.

With Hero FinCorp, you can manage your emergencies with confidence through a seamless, secure, and transparent digital loan procedure. You can complete the loan application in just a few easy steps without visiting a branch.

Here’s how you can apply:

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.